Chapter 7 Dynamic Models

7.1 Import Data

#insbeta=read.table(choose.files(), header=TRUE, sep="\t")

library(nlme)

insbeta=read.table("TXTData/insbeta.txt", sep ="\t", quote = "",header=TRUE)

insbeta$YEAR=1995+(insbeta$Time-1)/12This is the data used at page 302 for 8.6 Example: Capital Asset Pricing Model. No more information could be found.

7.2 Example 8.6: Capital Asset Pricing Model (Page 302)

The capital asset pricing model (CAPM) is a representation that is widely used in financial economics. An intuitively appealing idea, and one of the basic characteristics of the CAPM, is that there should be a relationship between the performance of a security and the performance of the market. One rationale is simply that if economic forces are such that the market improves, then those same forces should act upon an individual stock, suggesting that it also improve. We measure performance of a security through the return. To measure performance of the market, several market indices exist for each exchange. As an illustration, in the following we use the return from the “value-weighted” index of the market created by the Center for Research in Securities Prices (CRSP). The value-weighted index is defined by assuming a portfolio is created when investing an amount of money in proportion to the market value (at a certain date) of firms listed on the New York Stock Exchange, the American Stock Exchange, and the Nasdaq stock market.

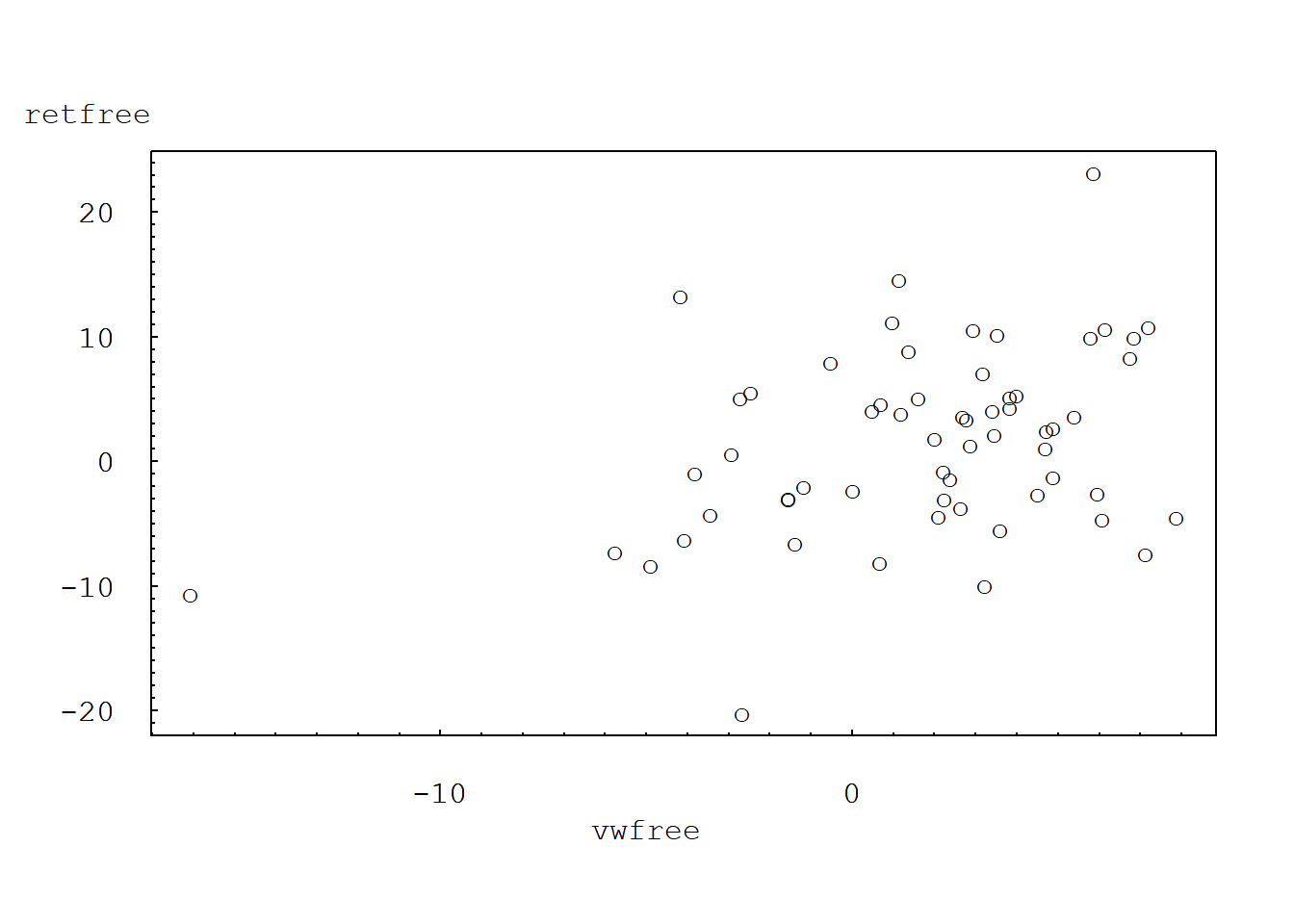

7.2.1 Plot of RETFREE vs. VWFREE for Incoln insurance company

plot(retfree ~ vwfree, data = subset(insbeta, insbeta$PERMNO==49015), type="p", xaxt="n", yaxt="n", ylab="", xlab="", font=10, cex=1, pch="o", las=1, mkh=0.0001, lwd=0.5)

axis(2, at=seq(-30, 30, by=10), las=1, font=10, cex=0.005, tck=0.01)

axis(2, at=seq(-30, 30, by=1), lab=F, tck=0.005)

axis(1, at=seq(-20,20, by=10), font=10, cex=0.005, tck=0.01)

axis(1, at=seq(-20,20, by=1), lab=F, tck=0.005)

axis(2, at=seq(-70, 110, by=10), las=1, font=10, cex=0.005, tck=0.01)

axis(2, at=seq(-70, 110, by=1), lab=F, tck=0.005)

axis(1, at=seq(-20,10, by=10), font=10, cex=0.005, tck=0.01)

axis(1, at=seq(-20,10, by=1), lab=F, tck=0.005)

mtext("retfree", side=2, line=0, at=28, font=10, cex=1, las=1)

mtext("vwfree", side=1, line=2, at=-5, font=10, cex=1)

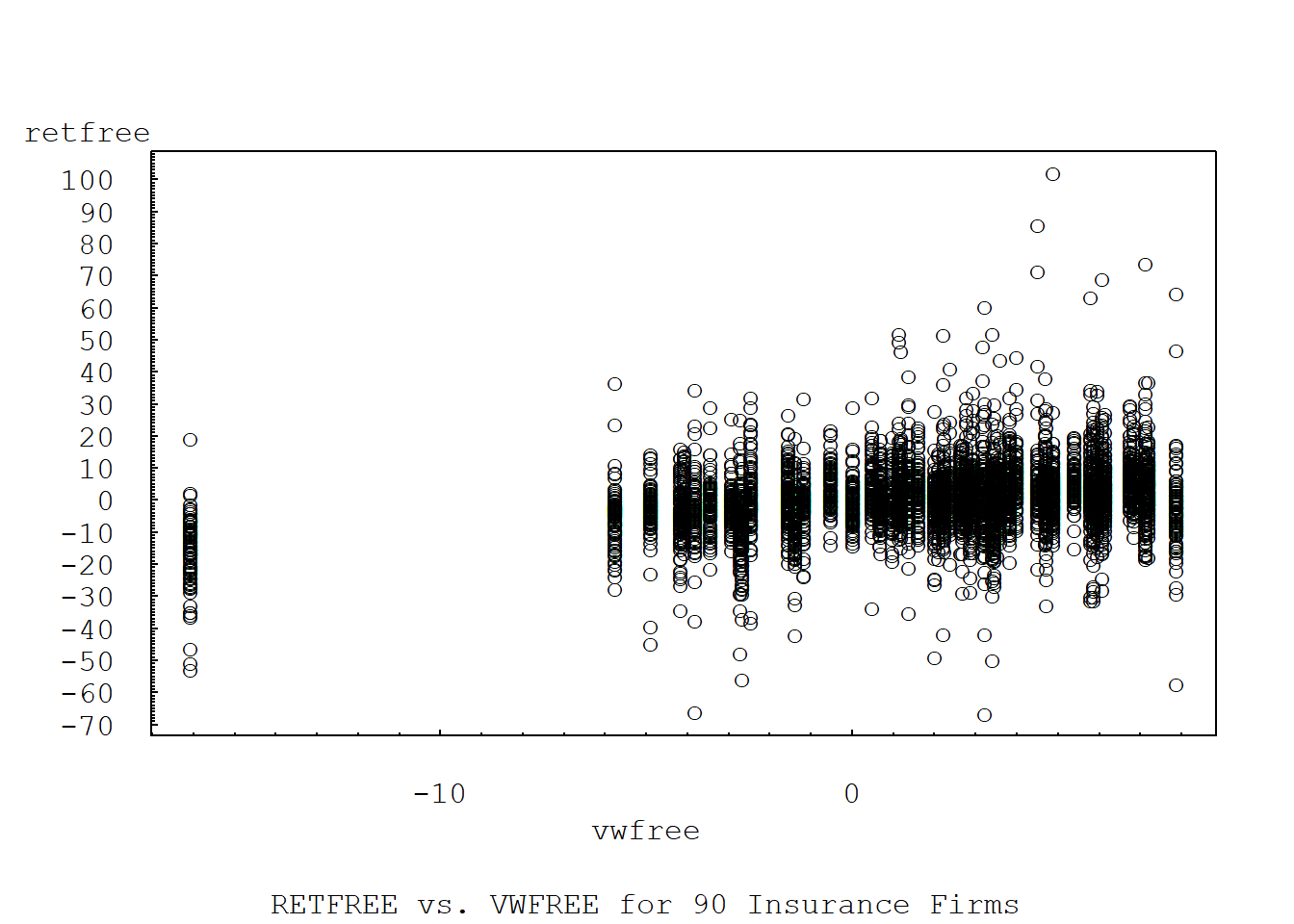

7.2.2 Plot of RETFREE vs. VWFREE for 90 insurance firms

plot(retfree ~ vwfree, data =insbeta, type="p", xaxt="n", yaxt="n", ylab="", xlab="", font=10, cex=1, pch="o", las=1, mkh=0.0001, lwd=0.5)

axis(2, at=seq(-70, 110, by=10), las=1, font=10, cex=0.005, tck=0.01)

axis(2, at=seq(-70, 110, by=1), lab=F, tck=0.005)

axis(1, at=seq(-20,10, by=10), font=10, cex=0.005, tck=0.01)

axis(1, at=seq(-20,10, by=1), lab=F, tck=0.005)

mtext("retfree", side=2, line=0, at=115, font=10, cex=1, las=1)

mtext("vwfree", side=1, line=2, at=-5, font=10, cex=1)

mtext("RETFREE vs. VWFREE for 90 Insurance Firms", side=1, line=4, at=-5, font=10, cex=1)

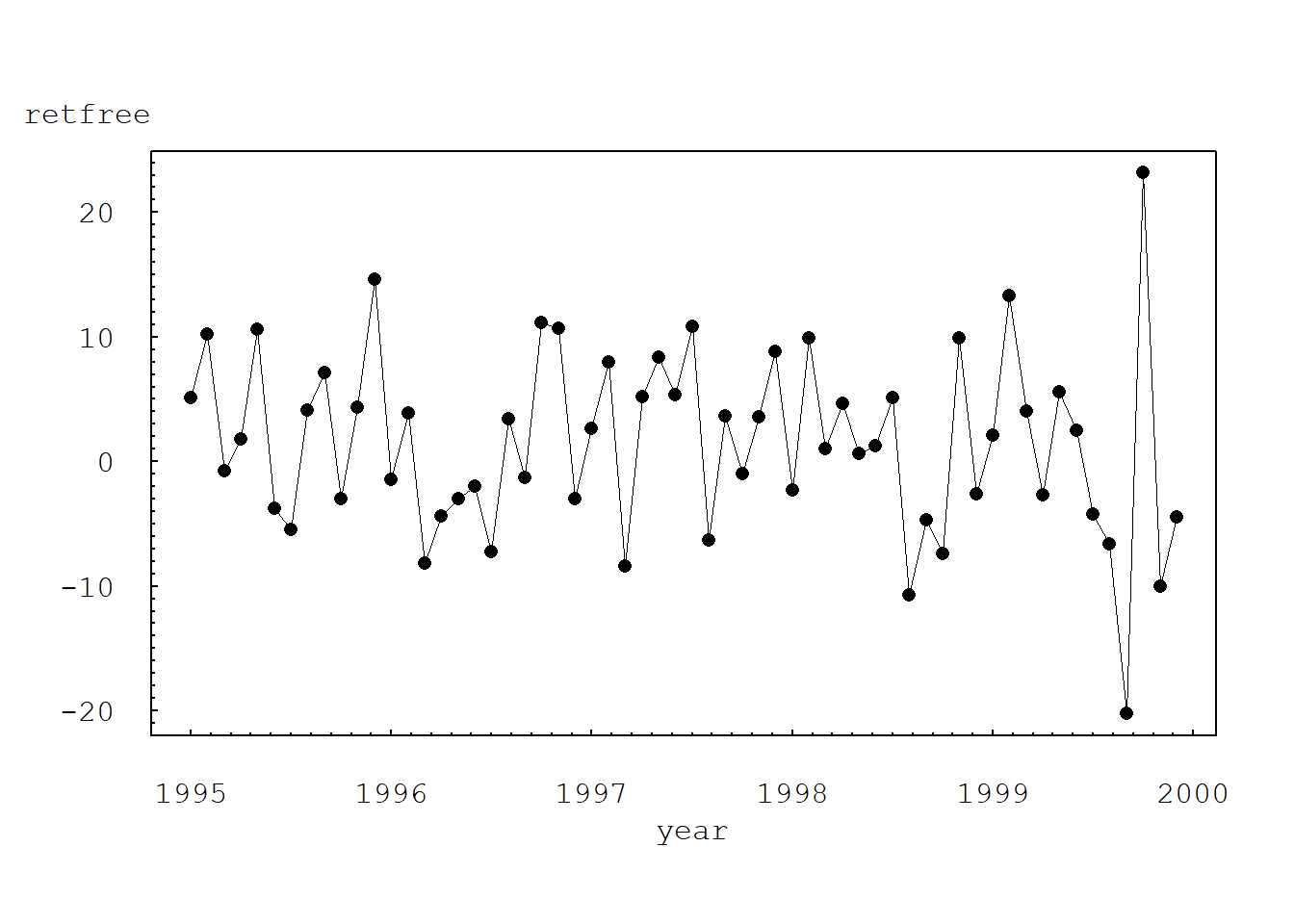

7.2.3 Plot of RETFREE vs. YEAR for Lincoln insurance company

plot(retfree ~ YEAR, data = subset(insbeta, insbeta$PERMNO==49015), type="o", xaxt="n", yaxt="n", ylab="", xlab="", font=10, cex=1, pch=16, las=1, mkh=0.0001, lwd=0.5)

axis(2, at=seq(-30, 30, by=10), las=1, font=10, cex=0.005, tck=0.01)

axis(2, at=seq(-30, 30, by=1), lab=F, tck=0.005)

axis(1, at=seq(1995,2000, by=1), font=10, cex=0.005, tck=0.01)

axis(1, at=seq(1995,2000, by=0.1), lab=F, tck=0.005)

mtext("retfree", side=2, line=0, at=28, font=10, cex=1, las=1)

mtext("year", side=1, line=2, at=1997.50, font=10, cex=1)

mtext("Lincoln RETFREE vs. YEAR", side=1, line=5, at=1997.50, font=10, cex=1)

7.2.4 Table 8.2 Summary statistics for market index and risk-free security

LINCOLN<-subset(insbeta, insbeta$PERMNO==49015)

summary(LINCOLN[, c("VWRETD", "SPRTRN", "riskf", "vwfree", "spfree")]) VWRETD SPRTRN riskf vwfree

Min. :-15.6765 Min. :-14.5797 Min. :0.2964 Min. :-16.0683

1st Qu.: -0.2581 1st Qu.: 0.1612 1st Qu.:0.3811 1st Qu.: -0.6755

Median : 2.9464 Median : 2.6730 Median :0.4147 Median : 2.5174

Mean : 2.0914 Mean : 2.0380 Mean :0.4075 Mean : 1.6839

3rd Qu.: 4.9429 3rd Qu.: 5.0748 3rd Qu.:0.4267 3rd Qu.: 4.5654

Max. : 8.3054 Max. : 8.0294 Max. :0.4829 Max. : 7.8798

spfree

Min. :-14.9714

1st Qu.: -0.2533

Median : 2.2244

Mean : 1.6305

3rd Qu.: 4.6481

Max. : 7.7330 sd1<-sqrt(diag(var(insbeta[,c("VWRETD", "SPRTRN", "riskf", "vwfree", "spfree")])))

sd1 VWRETD SPRTRN riskf vwfree spfree

4.09890088 3.98794716 0.03380599 4.09997511 3.98932881 cor(LINCOLN[,c("VWRETD", "SPRTRN", "riskf", "vwfree", "spfree")]) VWRETD SPRTRN riskf vwfree spfree

VWRETD 1.0000000 0.97950897 -0.02765660 0.99996603 0.97940410

SPRTRN 0.9795090 1.00000000 -0.03663843 0.97955443 0.99996414

riskf -0.0276566 -0.03663843 1.00000000 -0.03589477 -0.04509984

vwfree 0.9999660 0.97955443 -0.03589477 1.00000000 0.97951935

spfree 0.9794041 0.99996414 -0.04509984 0.97951935 1.00000000Table 8.2 summarizes the performance of the market through the return from the value-weighted index, VWRETD, and risk free instrument, RISKFREE. We also consider the difference between the two, VWFREE, and interpret this to be the return from the market in excess of the risk-free rate.

7.2.5 TABLE 8.3 Summary statistics for individual security returns

summary(insbeta[,c("RET", "retfree", "PRC")]) RET retfree PRC

Min. :-66.1972 Min. :-66.5785 Min. : 0.81

1st Qu.: -3.8462 1st Qu.: -4.2428 1st Qu.: 14.25

Median : 0.7453 Median : 0.3402 Median : 26.88

Mean : 1.0521 Mean : 0.6446 Mean : 547.11

3rd Qu.: 5.8823 3rd Qu.: 5.4675 3rd Qu.: 45.89

Max. :102.5000 Max. :102.0850 Max. :78305.00 # STANDARD DEVIATION

sd1<-sqrt(diag(var(insbeta[,c("RET", "retfree", "PRC")])))

sd1 RET retfree PRC

10.03772 10.03552 5178.49653 cor(insbeta[,c("RET", "VWRETD", "SPRTRN", "riskf", "retfree", "vwfree", "spfree")]) RET VWRETD SPRTRN riskf retfree

RET 1.00000000 0.2937725 0.28237030 0.06693926 0.99999435

VWRETD 0.29377254 1.0000000 0.97950897 -0.02765660 0.29393029

SPRTRN 0.28237030 0.9795090 1.00000000 -0.03663843 0.28255580

riskf 0.06693926 -0.0276566 -0.03663843 1.00000000 0.06358534

retfree 0.99999435 0.2939303 0.28255580 0.06358534 1.00000000

vwfree 0.29314362 0.9999660 0.97955443 -0.03589477 0.29332899

spfree 0.28170525 0.9794041 0.99996414 -0.04509984 0.28191911

vwfree spfree

RET 0.29314362 0.28170525

VWRETD 0.99996603 0.97940410

SPRTRN 0.97955443 0.99996414

riskf -0.03589477 -0.04509984

retfree 0.29332899 0.28191911

vwfree 1.00000000 0.97951935

spfree 0.97951935 1.00000000Table 8.3 summarizes the performance of individual securities through the monthly return, RET. These summary statistics are based on 5,400 monthly observations taken from 90 firms. The difference between the return and the corresponding risk-free instrument is RETFREE.

7.2.6 TABLE 8.4 Fixed effects models

#HOMOGENEOUS MODEL

insbetahomo<-gls(retfree~vwfree, method="REML", data=insbeta)

anova(insbetahomo)Denom. DF: 5398

numDF F-value p-value

(Intercept) 1 24.3686 <.0001

vwfree 1 508.1788 <.0001insbetahomo$sigma^2[1] 92.06322AIC(insbetahomo)[1] 39757.19logLik(insbetahomo)*(-2)'log Lik.' 39751.19 (df=3)insbeta$FACPERM<-factor(insbeta$PERMNO)

#VARIABLE INTERCEPT MODEL

insbetafx1<-gls(retfree~vwfree+FACPERM, method="REML", data=insbeta)

anova(insbetafx1)Denom. DF: 5309

numDF F-value p-value

(Intercept) 1 24.2193 <.0001

vwfree 1 505.0665 <.0001

FACPERM 89 0.6285 0.9975insbetafx1$sigma^2[1] 92.63053AIC(insbetafx1)[1] 39672.63logLik(insbetafx1)*(-2)'log Lik.' 39488.63 (df=92)#VARIALBE SLOPES MODEL

insbetafx2<-gls(retfree~vwfree*FACPERM-vwfree-FACPERM, method="REML", data=insbeta)

anova(insbetafx2)Denom. DF: 5309

numDF F-value p-value

(Intercept) 1 24.712995 <.0001

vwfree:FACPERM 90 7.562791 <.0001insbetafx2$sigma^2[1] 90.78022AIC(insbetafx2)[1] 39830.52logLik(insbetafx2)*(-2)'log Lik.' 39646.52 (df=92)#VARIABLE INTERCEPTS AND SLOPES MODEL

insbetafx3<-gls(retfree~vwfree*FACPERM, method="REML", data=insbeta)

anova(insbetafx3)Denom. DF: 5220

numDF F-value p-value

(Intercept) 1 24.6569 <.0001

vwfree 1 514.1906 <.0001

FACPERM 89 0.6399 0.9966

vwfree:FACPERM 89 2.0776 <.0001insbetafx3$sigma^2[1] 90.98683AIC(insbetafx3)[1] 39712.59logLik(insbetafx3)*(-2)'log Lik.' 39350.59 (df=181)#VARIABLE SLOPES MODEL WITH AR(1) TERM

insbetafx4<-gls(retfree~vwfree:FACPERM, data=insbeta, method="REML", correlation=corAR1(form=~1|PERMNO)) #Model probably not working

anova(insbetafx4)Denom. DF: 5309

numDF F-value p-value

(Intercept) 1 29.285237 <.0001

vwfree:FACPERM 90 7.941803 <.0001insbetafx4$sigma^2[1] 90.76872AIC(insbetafx4)[1] 39796.92logLik(insbetafx4)*(-2)'log Lik.' 39610.92 (df=93)insbetafx4$modelStructcorStruct parameters:

[1] -0.1689266Table 8.4 summarizes the fit of each model. Based on these fits, we will use the variable slopes with an \(AR(1)\) error term model as the baseline for investigating time-varying coefficients.

Then we can include random effects:

insbetarm<-lme(retfree~vwfree, data=insbeta, random=~vwfree-1|PERMNO) #Random - Effects Model

insbetarco<-lme(retfree~vwfree, data=insbeta, random=~1+vwfree|PERMNO, correlation=corAR1(form=~1|PERMNO),control = lmeControl(opt = "optim"))

#due to convergence problem, I add the "control = lmeControl(opt = "optim")".

#Random - Coefficients Model

summary(insbetarm)Linear mixed-effects model fit by REML

Data: insbeta

AIC BIC logLik

39738.53 39764.91 -19865.27

Random effects:

Formula: ~vwfree - 1 | PERMNO

vwfree Residual

StdDev: 0.2569603 9.527865

Fixed effects: retfree ~ vwfree

Value Std.Error DF t-value p-value

(Intercept) -0.5644229 0.14016877 5309 -4.026737 1e-04

vwfree 0.7179819 0.04164033 5309 17.242464 0e+00

Correlation:

(Intr)

vwfree -0.289

Standardized Within-Group Residuals:

Min Q1 Med Q3 Max

-7.18150077 -0.49947031 -0.02643177 0.46193572 10.17362517

Number of Observations: 5400

Number of Groups: 90 summary(insbetarco)Linear mixed-effects model fit by REML

Data: insbeta

AIC BIC logLik

39697.8 39743.95 -19841.9

Random effects:

Formula: ~1 + vwfree | PERMNO

Structure: General positive-definite, Log-Cholesky parametrization

StdDev Corr

(Intercept) 0.5759112 (Intr)

vwfree 0.3182517 -0.831

Residual 9.5058076

Correlation Structure: AR(1)

Formula: ~1 | PERMNO

Parameter estimate(s):

Phi

-0.08830483

Fixed effects: retfree ~ vwfree

Value Std.Error DF t-value p-value

(Intercept) -0.5905640 0.14322023 5309 -4.123468 0

vwfree 0.7378101 0.04596025 5309 16.053222 0

Correlation:

(Intr)

vwfree -0.508

Standardized Within-Group Residuals:

Min Q1 Med Q3 Max

-7.20057083 -0.49733487 -0.02677384 0.46069650 10.22355808

Number of Observations: 5400

Number of Groups: 90 Cleaning up companies with more than one Ticker names but having the same PERMNO:

tab<-as.matrix(xtabs(~PERMNO+TICKER, insbeta)) #a logical matrix cross-tabulation of PERMNO and TIcker

which(rowSums(tab>0)>1)10085 10388 10933 11203 11371 11406 11713 22198 37226 48901 52936 58393

1 5 10 12 13 14 16 24 30 41 44 50

60687 76099 76697 77052 77815

56 72 79 83 86 # PERMNOs that have more than one ticker

#10085 10388 10933 11203 11371 11406 11713 22198 37226 48901 52936 58393 60687

# 1 5 10 12 13 14 16 24 30 41 44 50 56

#76099 76697 77052 77815

# 72 79 83 86

# For each PERMNO go through the following code check on the the TICKER names and frequency

# which(tab["10388",]>0)

#TREN TWK

# 96 99

#> tab["10388", c(96,99)]

# TREN TWK

# 57 3 # THIS SHOWS THE FREQUENCY AS WELL AS THE TICKER NAMES FOR ONE SINGLE PERMNO "10388"Recode Tickers:

insbeta$TICKER[insbeta$PERMNO=="10085"]<-"UICI"

insbeta$TICKER[insbeta$PERMNO=="10388"]<-"TREN"

insbeta$TICKER[insbeta$PERMNO=="10933"]<-"MKL"

insbeta$TICKER[insbeta$PERMNO=="11203"]<-"PXT"

insbeta$TICKER[insbeta$PERMNO=="11371"]<-"HCCC"

insbeta$TICKER[insbeta$PERMNO=="11406"]<-"CSH"

insbeta$TICKER[insbeta$PERMNO=="11713"]<-"PTAC"

insbeta$TICKER[insbeta$PERMNO=="22198"]<-"CRLC"

insbeta$TICKER[insbeta$PERMNO=="37226"]<-"FOM"

insbeta$TICKER[insbeta$PERMNO=="48901"]<-"MLA"

insbeta$TICKER[insbeta$PERMNO=="52936"]<-"MCY"

insbeta$TICKER[insbeta$PERMNO=="58393"]<-"RLR"

insbeta$TICKER[insbeta$PERMNO=="60687"]<-"AFG"

insbeta$TICKER[insbeta$PERMNO=="76099"]<-"DFG"

insbeta$TICKER[insbeta$PERMNO=="76697"]<-"FHS"

insbeta$TICKER[insbeta$PERMNO=="77052"]<-"UWZ"

insbeta$TICKER[insbeta$PERMNO=="77815"]<-"EQ"Retuen the following checking the consistency between PERMNO and TICKER:

tab<-as.matrix(xtabs(~PERMNO+TICKER, insbeta))

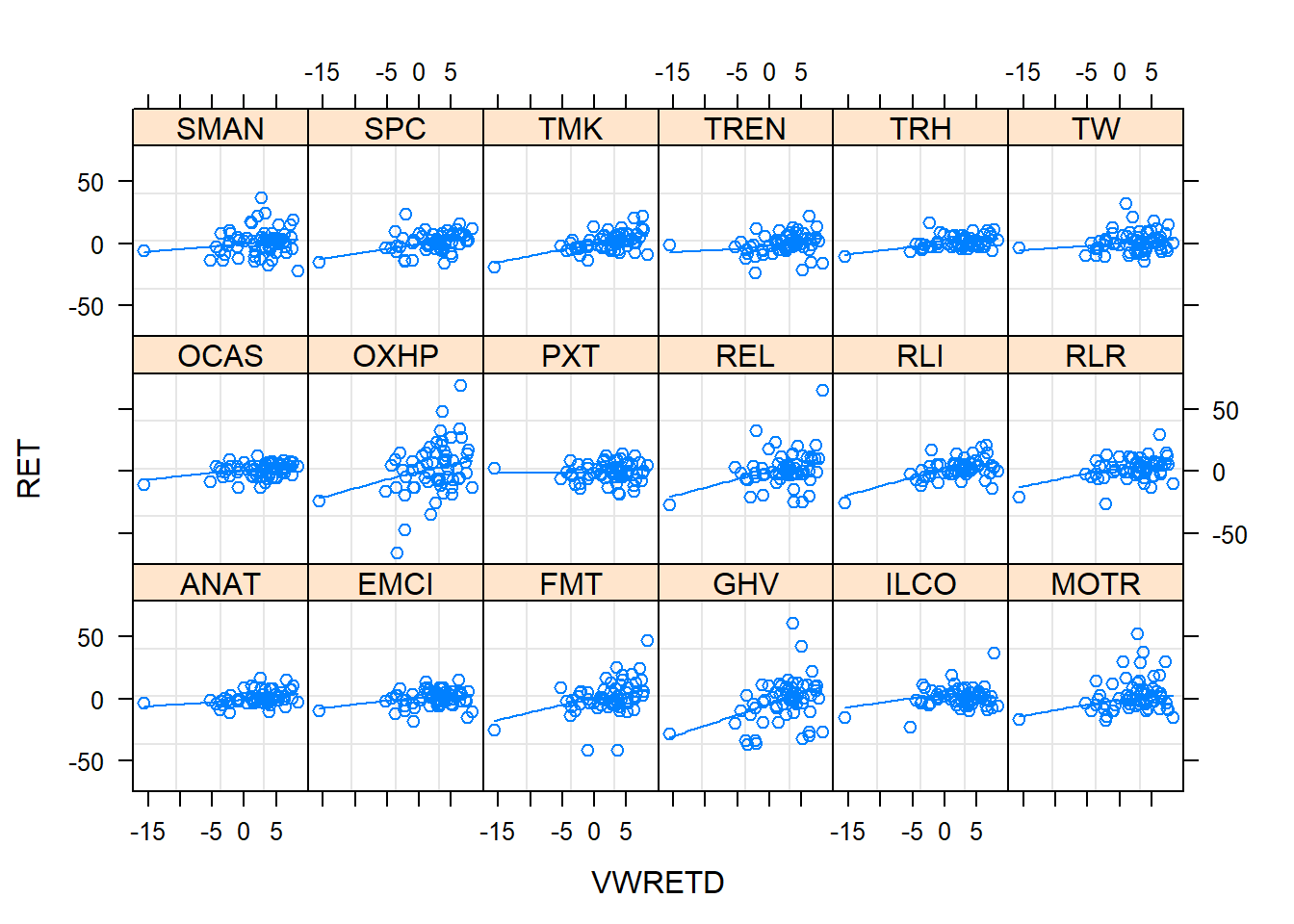

which(rowSums(tab>0)>1) #RESULT SHOULD BE ZEROnamed integer(0)7.2.7 Figure 8.1: Trellis plot of returns versus market return

#PRODUCE A TRELLIS PLOT TO SHOW VARYING BETAS

library(lattice)

insbeta$ID=factor(insbeta$PERMNO)

insbeta$TK=factor(insbeta$TICKER)

sampbeta <- subset(insbeta, ID %in% sample(levels(insbeta$ID), 18, replace=FALSE) )

xyplot(RET ~ VWRETD | TK, data=sampbeta, layout=c(6,3,1), panel = function(x, y) {

panel.grid()

panel.xyplot(x, y)

panel.loess(x, y, span = 1.5)

})